Hiring Independent Contractors

Hiring Independent Contractors

Hiring independent contractors can be a fantastic hiring and talent solution for businesses. These freelancers (also called gig workers, 1099 workers, and sole proprietors), can help you expand your team without the commitment and expense of hiring full-time or part-time employees. Many businesses rely on independent contractors in some form or fashion to benefit their operations.

The great thing about hiring these “non-employee” workers is that you can tap into talent that you may not have access to otherwise, all while keeping an eye on your bottom line. It’s a win-win! As more and more businesses embrace this contemporary trend, it’s important to understand the basics of how and why independent contracting works.

The right contractor can provide you with flexibility in managing projects and help you save money on overhead costs. Since you only pay them for the work they do, you don’t have to worry about providing equipment or benefits, or paying employment taxes. It can be a very cost-effective solution for your business.

However, it’s also important to be aware of the potential risks associated with relying on independent contractors. These risks could end up causing you headaches and money down the line. As a business owner, it’s crucial to take the right steps to protect your business from liability exposure or an audit from the friendly folks at the IRS or a state agency.

"It's Important to be aware of the potential risks assoicated with relying on independent contractors"

We know it might be tempting to overlook the risks or assume that your business is too small to be affected, but understanding the full picture of contractor relationships is essential to avoid any surprise costs later on. Don’t worry, there are ways to mitigate your risk while still enjoying all the benefits and flexibility of hiring contractors. First, let’s make sure you understand all the important pieces…

There are Hidden Risks to Hiring Independent Contractors

Well, it’s not even that they are hidden as much as they just aren’t well known or understood. So, let’s cover it here…

The Risks of Hiring Independent Contractors

Let’s talk about some of the risks that businesses can face when hiring independent contractors. Don’t worry, we’ll go into more detail about each point below!

- One big risk is the potential for audits from the IRS and other agencies. Hiring Independent Contractors can sometimes trigger audits, and we’ll talk about what those triggers are in just a bit.

- Another risk is the possibility of worker lawsuits. Sometimes workers may feel like they should have been classified as employees rather than independent contractors, and they may take legal action if they believe their treatment is more like that of an employee than a vendor .

- Independent Contractors filing for unemployment is another potential risk. If an Independent Contractor files for unemployment insurance, it can prompt the state to investigate whether they should have been classified and paid as an employee instead.

- Independent Contractors filing for unemployment is another potential risk. If an Independent Contractor files for unemployment insurance, it can prompt the state to investigate whether they should have been classified and paid as an employee instead.

There’s also the issue of Independent Contractors failing to file their taxes. Even if you, as the business, file their 1099 form, if they don’t file their own tax return, it can cause problems with the IRS and state authorities. Here are some steps to follow when hiring a 1099 worker.

- Independent Contractors filing for unemployment is another potential risk. If an Independent Contractor files for unemployment insurance, it can prompt the state to investigate whether they should have been classified and paid as an employee instead.

5. In some cases, Independent Contractors may need traditional benefits, such as workers’ compensation and medical insurance, if they get injured or become ill. However, if there are no benefits available, it can create challenges for both the Independent Contractor and the business.

6. The independent contractor you engage does not have liability insurance and puts your business at risk.

7. Lastly, misclassification of a worker as an Independent Contractor when they should have been an employee is a significant risk. In fact, many of the risks we’ve mentioned are connected to misclassification. So, it’s essential to get the classification right from the start.

"If an Independent Contractor files for unemployment, it can prompt the state to investigate whether they should have been classified and paid as an employee."

The Risk of Misclassification of an Independent Contractor

Let’s dig into the topic of misclassification a bit more. Even the term itself can make you tilt your head and go, “Huh?!” This is probably the most pervasive and pressing risk to a business as it relates to its contractors, so it’s important to understand. Essentially, employee misclassification happens when a business wrongly classifies a worker as an independent contractor instead of an employee under the guidelines of the IRS or other federal and state agencies.

"Employee misclassification happens when a business wrongly engages a worker as an independent contractor instead of an employee under the guidelines of employment regulations."

This often happens when businesses want to avoid paying taxes and benefits that are required for employees, or when they want to sidestep labor laws and regulations. It could be the worker driving the type of relationship and won’t work as an employee.

Sometimes it’s just a misunderstanding about the rules, especially for smaller businesses. It can start innocently enough – you hire someone to help out for a few hours a week, and then suddenly you realize you have an employee instead of an independent contractor. Or maybe you hire someone without realizing that you can’t dictate their hours or what equipment they use. Before you know it, you have a team of misclassified employees.

The reason why the government takes this issue seriously is because it affects the rights of workers. When someone is classified as an independent contractor instead of an employee, they miss out on benefits and protections like minimum wage, overtime pay, workers’ compensation, and unemployment insurance. Even if you voluntarily provide some of these benefits, the government still sees it as non-compliance, which could have serious legal and financial consequences.

To add to the confusion, different states have different rules and agencies with their own legal mandates. It’s enough to make your head spin, right?

At the Federal level, the main agencies are the IRS and the Department of Labor (DOL). The IRS is mainly concerned with tax implications, so its definition of an employee versus an independent contractor focuses on issues like control and financial arrangement. If you’re wondering if you comply with the IRS classification requirements, you can check out this article.

The other federal agency, the Department of Labor, is more focused on labor and employment law, and its definition of an employee may include additional factors like the nature of the work and required skill level.

Sometimes there are even gray areas where it’s hard to determine how a worker should be classified. For example, one agency may classify someone as an independent contractor while another agency sees them as an employee, depending on the specific circumstances of their work and the nature of the business’ industry.

Overall, the differences in definitions between government agencies reflect the diverse legal and policy contexts they operate in. It’s important for employers and workers to be aware of these variations and seek legal guidance if needed to ensure compliance with regulations.

The Risks of Audits When Hiring Independent Contractors

"There are a number of different triggers that can set off an audit."

There are different triggers that can set off an audit, such as:

- A state or federal agency suspects a worker is misclassified based on their data analysis such as a worker receiving a 1099 and W-2 form in the same tax year or the business’ ratio of W-2 forms issued compared to the number of 1099 forms issued.

- A worker files a Form SS-8 because they’re uncertain about their employment status.

- In the event an independent contractor doesn’t properly file their taxes.

- If an independent contractor files for unemployment or workers’ compensation.

- Sometimes, complaints from workers or other sources can also lead to an audit, and certain industries or occupations may be targeted for audits too.

- A random selection for an audit.

- An audit by one agency triggers other audits due to sharing of data between the agencies.

During an audit, the auditor will carefully review all the documentation related to the Independent Contractor relationship like the agreement, the payment terms, job duties, and other provisions. They’ll compare this information with local, state, and federal laws to see if everything is in compliance with the requirements for independent contractors.

If an independent contractor is found to have been misclassified, meaning that they really should have been hired as an employee, your business may face a number of severe financial consequences such as:

Payment of the employer taxes that should have been paid

Repayment of past employment taxes

Penalties for misclassifying the worker

Penalties for not paying taxes and fees when the agency determines they should have been paid (i.e. late payment penalties).

Interest for the time that has lapsed between when the taxes are paid compared to when they should have been paid as well as on the penalties incurred.

Benefits the worker should have received, such as health insurance, paid time off, retirement contributions.

Fines for not paying taxes and other fees when they would have been originally due

If the classification is deemed willful, there could be personal penalties to the owner / decision maker

ACA penalties if the business should have offered qualified medical coverage.Penalties for not paying mandatory sick pay or conducting mandatory harassment training

Wage and hour penalties if the worker should have been paid a premium rate such as overtime / double time per the federal and state regulations or minimum wage. It’s vital to stay current with your local minimum wage requirements.

"Once regulatory agencies have justified auditing your records, you’ll most likely be placed on a “re-audit” list for 3 or 4 years."

Even more concerning is that these fines and penalties will be collected by the agencies who imposed them and they have special collection rights and protections that make it impossible to avoid or side step these payments. This includes the ability for these agencies to collect your personal monies and assets to satisfy these debts.

After your audit and face any imposed fees and penalties, you will be required to rectify the worker’s status to be compliant with their required classification status. This might involve revising the independent contractors agreement or scope of work, hiring them as an employee or engaging an Employer of Record service in order to stay compliant. Oh and you’ll most likely be placed on a “re-audit” list for 3 or 4 years, depending on the auditing agency.

The Risk of Worker Lawsuits

If a worker feels like they’ve been denied benefits they have options, and one of them is suing their employer. It’s not uncommon for workers to bring a lawsuit if they believe they’ve been misclassified as an independent contractor when they should actually be considered an employee. This type of lawsuit often arises when employees aren’t receiving the benefits that come with being an employee, such as health insurance, overtime pay, and vacation days, to name a few, but are asked to work as independent contractors of a business.

If a worker can successfully show that they’ve been misclassified, they may be entitled to wages that should have been paid i.e. overtime or premium time, as well as benefits, and other compensation that’s typically reserved for employees. Of course, the outcome will depend on various factors related to the case.

Now that you understand the misunderstood risks of hiring Independent Contractors, let’s discuss how to properly retain Independent Contractors in your business while staying in compliance with different regulations.

"If a worker can successfully show that they've been misclassified, they may be entitled to wages that should have been paid."

Guidelines for Hiring Independent Contractors vs Employers

In order for a worker to be hired and properly classified as an Independent Contractor there are five key areas in which that contractor must have control:

Behavioral Control: Independent contractors must have the freedom to decide how, when, and where they work, as well as the tools they use. After all, they’re usually experts in their field, so giving them some autonomy can be a good thing!

Financial Control: Independent Contractors must retain financial control to be considered contractors. This is most typically viewed as the opportunity to seek out additional business opportunities in the marketplace – freedom to offer their services to other clients. Additional measures of financial control might be:

- Having business expenses that are not eligible for reimbursement

- The risk of a profit vs a loss

- Payments are often a flat fees vs hourly compensation

Relationship of the Parties: The relationship between a business and an individual and the same business and their independent contractors is significant. Factors include if there is a written contract, benefits, or a permanency of working relationship.

Nature of the Work: This is a big one and is often misunderstood. Independent contractors cannot provide services that are integral to the services that the business provides. For instance, a law firm would be ill advised to hire its lawyers as independent contractors – as legal services is the primary service of that business. More on this below.

Legal Status: it’s important to take steps to remain legally compliant. This means that the contractor is able to provide proof of their business status, additional sources of income, and insurance. Although a legal agreement is not enough when it comes to an audit. The auditor is going to evaluate all aspects of the work to be done and the relationship.

"Independent contractors cannot provide services that are integral to the services that the business provides."

How to Protect Your Business and Assets from an Independent Contractor Audit

It’s a good idea to know and understand how the IRS defines an independent contractor so you can make the appropriate hiring decisions.

Audit Protection #1: Make sure that you have properly classified your workers.

Based on the criteria above, be sure to know if your contractors are properly classified as independent contractors or if they should really be employees.

If you want to keep the flexibility of independent contractors – we have good news for you. There are ways to properly classify workers as contractors and still be in compliance.

Audit Protection #2: Make sure your independent contractors have the proper documentation

Some of the common documents you (and the contractor) will need include:

- Contracts or agreements between you and your contractor

- Documentation showing the behavior controls between the two parties that supports the independent contractor classification

- Documentation showing the financial controls between the two parties that supports the independent contractor classification

- Documentation showing the relationship of parties support the independent contractor classification

- Documentation of the independent contractor’s business structure, history and financial liability. Do they have business insurance to protect their business and yours?

- Tax documents such as a W-9 form proving the independent contractor’s tax filing status

By having these documents ready if needed, you can help make sure that everything is handled properly during an audit. It’s also wise to keep copies of all invoices, payments and tax returns filed so that any discrepancies can be easily identified and corrected in a timely manner.

Audit Protection #3: Limit Independent Contractors to the Appropriate Scope of Work

To protect your business, limit the type of the work your independent contractors are hired to perform. There are a few guidelines to help determine the appropriate scope of work for contractors.

First, contracted work should be the specific expertise of that independent contractor. Second, the assignments should not include duties that are integral to the services that the business provides. And third the scope of work should not include duties that are typically performed by employees.

A good example is that a law firm would not consider hiring a lawyer as an independent contractor as legal services is the service that business offers. It is not acceptable to hire independent contractors to fulfill integral business offerings.

If you would like to sub-contract the services you offer to your clients there is a way to do that within the bounds of employment regulations – keep reading to learn more.

Audit Protection #4: Document Your 1099 Compliance

Use a tool such as ClearIC to ensure Independent Contractor compliance and build a case Defense File to have on hand in the case of an audit.

The benefits of ClearIC is not only documentation but also the advantage of experts to review and advise your current worker status.

"Tools such as ClearIC help to ensure Independent Contractor compliance."

What Happens When an Independent Contractor Should Have Been Classified as an Employee

Misclassifying an independent contractor as an employee can come with serious penalties. The IRS may impose fines, require back taxes with interest, and even make you pay for any unpaid wages or benefits owed to the misclassified worker.

On top of that, misclassified employees may miss out on certain benefits and protections they would be entitled to as employees, such as overtime pay, workers’ compensation insurance, and unemployment insurance, as well as other federal and state employment law protections.

In some cases, misclassification can even lead to civil or criminal proceedings, which could result in jail time. So it’s crucial to make sure you’re correctly classifying your workers.

There’s even a case where an independent contractor was awarded $1.3 million for misclassification.

A handy rule of thumb is to consider the level of control you need to have over a worker. If the job requires them to work specific hours, receive training you provide, use your equipment, or follow particular guidelines, then they should likely be classified as employees.

It’s always better to be safe than sorry when it comes to worker classification. If you’re unsure or confused about how to classify a worker, it’s a good idea to seek advice from a qualified professional. Remember, taking the right steps now can save you from potential issues down the road!

Maintaining the Benefits of Hiring Independent Contractors

"Not all workers need to be classified as employees. There is still plenty of room to hire independent contractors."

Despite all of the potential risks, there can also be great benefits to hiring independent contractors, especially if you need someone to do short term project work or you don’t need a full-time employee.

It is important to understand that not all workers need to be classified as employees. There is still plenty of room to hire independent contractors in your business.

And even better news is that there are ways to hire workers with all the flexibility of independent contractors without the need to bring them on to your payroll.

Introducing: Employer of Record Services

An Employer of Record (EOR) is a friendly third-party organization that takes care of all the administrative and HR-related tasks so you can focus on your work without the hassle of being the employer.

With an EOR, you won’t need to worry about compliance or other administrative overhead. They handle all the legal requirements of on-boarding an employee, payroll processing, tax withholding, benefits administration, and compliance with labor laws and regulations, so you can have peace of mind knowing everything is taken care of.

Not only does using an EOR save you time and money by accessing a pool of qualified contractors without the risk and administrative work of hiring and managing them directly, but it also provides required benefits to the workers themselves.

Employers of Record services are well-versed in local regulations, so they provide an extra layer of protection no matter where the workers are located. This means you can focus on growing your business while leaving the compliance worries to the experts.

Overall, an EOR can be the ideal solution for employers to leverage all the benefits of engaging with independent contractors like workers while minimizing administrative burdens and compliance risk.

You can learn more about our Employer of Record Services here and Contact Us about if and when you should hire an Independent Contractor or Employee.

No Legal Advice Intended. This article includes general information about legal issues and developments in the law. Such materials are for informational purposes only and may not reflect the most current legal developments. These informational materials are not intended, and must not be taken, as legal advice on any particular set of facts or circumstances. You need to contact a lawyer licensed in your jurisdiction for advice on specific legal issues.

Contingent and Remote Workers in Your Business

When it comes to hiring workers for her business, Barbara Business Owner is realizing that there are a number of workforce solutions available. While the two primary hiring approaches are 1099 or employee, the options, criteria, and regulations around both

1099s in Your Business

When Barbara Business Owner was looking to expand her team to support her growing business, she started to delve into the world of workforce options beyond the traditional full-time and part-time employees. There are independent contractors, contingent workers, and remote

Employees in Your Business

Barbara Business Owner considers herself lucky to have very supportive friends who are also business owners. Recently, she decided to hire new talent to support her growing business, and her fellow business owners helped her realize the basic differences between a

1099 or Employee – What Every Employer Should Know

Barbara Business Owner’s firm is flourishing and it’s time to hire. Barbara needs help with both client work and has several projects she needs completed to support her business growth. As Barbara has been chatting with her fellow business owners

Paid Family Leave vs Mandatory Sick Pay

Paid Family Leave vs Mandatory Sick Pay Brandon Business Owner has just scheduled a call with Holly Human Resources to understand why an additional policy for Sick Pay had been added to the Employee Handbook. Brandon was sure that they

Independent Contractors and Audit Risks

Independent Contractors and Audit Risks Hiring Independent Contractors Independent contractors are great – you can ask Barbara Business Owner, Brandon Business Owner, or Holly Human Resources. They will all agree that there is a time and place when contractors are

3 Benefits of Hiring Independent Contractors

3 Benefits of Hiring Freelancers For Your Business Do you know the benefits hiring an independent contractor can bring to your business? The other day I was having a conversation with my friend Barbara Business-Owner. She runs a law firm

EEOC Equal Pay Day March 12th, 2024

EEOC Equal Pay Day March 12th, 2024 This week, we take a walk through history as we celebrate Equal Pay Day. Equal Pay Day Happy Equal Pay Day! The first Equal Pay Day was on April 11, 1996, to represent

Informal vs. Formal Grievance Policy: Which one will help you to stay compliant?

Informal vs. Formal Grievance Policy: Which one will help you to stay compliant? Barbara Business Owner and Brandon Business Owner are having a lively debate during a business roundtable. They’re actually in the middle of an important discussion around formal

Help Is on the Way: EOR vs Staffing Agency – Understanding the Difference

Help Is on the Way: EOR vs Staffing Agency – Understanding the Difference In a recent article, we covered the difference between staffing agencies and Employer of Records (EORs) for direct hires. Today, let’s delve into the type of ongoing

5 Employee Compliance Regulations that Vary by State

5 Employee Compliance Regulations that Vary by State Brandon Business Owner is on top of the world today, and business is good. He recently decided to take his workforce entirely remote, cutting down on business expenses while increasing the autonomy

Independent Contractors and the ABC Test

Independent Contractors and the ABC Test Barbara Business Owner was managing an influx of new clients at her law firm and the workload was overwhelming. Her firm was steadily growing and these growth spurts made it challenging to keep up

Unpaid School Leave Laws: Insights and Strategies for Employers

Unpaid School Leave Laws: Insights and Strategies for Employers School is in session and here is the test: Do you know what school leave laws apply to your company? Brandon Business Owner was breezing through his morning emails when

2024 FLSA Update and Business’ Next Steps

2024 FLSA Update and Business’ Next Steps Recently, the Department of Labor (DOL) released the 2024 updated rule on how to analyze who is an employee or independent contractor under the Fair Labor Standards Act (FLSA). The Fair Labor Standards

Agent of Record: Streamlining Independent Contractor Management

Agent of Record: Streamlining Independent Contractor Management In the dynamic world of modern business, Brandon’s journey stands out. Starting as a small startup, his company has grown exponentially, a testament to his innovative approach to staffing. Embracing the gig economy,

Semi-Annual Update – Minimum Wage Rates – January 2024

Our Semi-annual Update of Minimum Wage Rate Changes ClearPath keeps up with the state-by-state (and city-by-city in some cases) minimum wage rates changes. Is your state or city’s minimum wage increasing again? If you employ workers, you should check to

Semi-Annual Update – Paid Sick Leave Ordinances – January 2024

Our Semi-annual Update of Paid Sick Leave Ordinances ClearPath keeps up to date on the expanding changes to paid sick leave requirements. As a result of the gaps left by the federal response to the pandemic, state and local

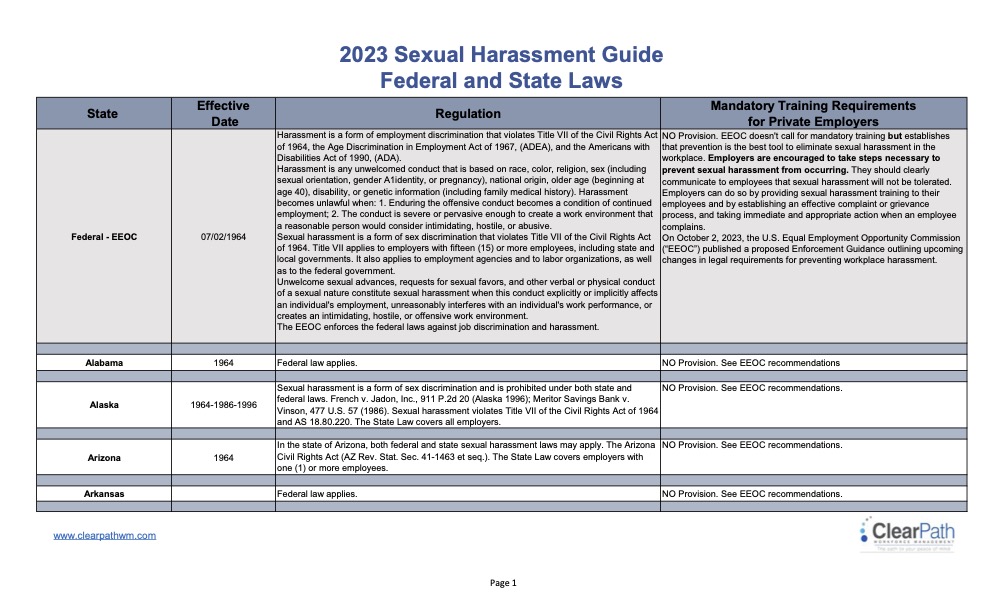

Semi-Annual Update – Sexual Harassment Training Requirements – January 2024

Sexual Harassment Training Mandates by State for 2024 Preventing sexual harassment has been on the agenda for most companies since Title VII of the Civil Rights Act of 1964, which prohibits sexual harassment and discrimination in the workplace. But

Direct Hire vs. Staffing Agency: How EOR Offers a Balanced Solution

Direct Hire vs. Staffing Agency: How EOR Offers a Balanced Solution The hiring process is a crucial aspect of any business’s growth and success. Companies often grapple with the decision between direct hiring and using staffing agencies. Meet Brandon Business

![2023 is Coming to a Close: Are You Compliant? [The Essential Checklist]](https://149871266.v2.pressablecdn.com/wp-content/uploads/2023/12/2023.12.12-2023-is-Coming-to-a-Close-Are-You-Compliant-The-Essential-Checklist-PHOTO-ONLY-1024x683.png)

2023 is Coming to a Close: Are You Compliant? [The Essential Checklist]

2023 is Coming to a Close: Are You Compliant? [The Essential Checklist] The end of the year is the perfect time for business owners to review their compliance status. As you reflect on the growth and progress of your business,

Leveraging the Contingent Workforce Without the Headache

Leveraging the Contingent Workforce Without the Headache The flexible work economy is booming; it’s on the rise and growing. In the evolving landscape of work, the contingent workforce has emerged as a key element for businesses seeking flexibility and specialized

7 Ways to Save Money on HR Expenses through Employer of Record (EOR) Services

7 Ways to Save Money on HR Expenses through Employer of Record (EOR) Services In today’s fast-paced business world, managing a growing team can be a complex and costly affair. Many business owners find themselves weighed down by the administrative

The New Age of Hiring: Navigating Multi-State Employee Compliance

The New Age of Hiring: Navigating Multi-State Employee Compliance In today’s digital age, hiring outside your local area is becoming the norm. Thanks to technology, businesses can expand their horizons, both internally and externally. But with this newfound flexibility comes

3 Employee Documentation Requirements for HR Compliance

3 Employee Documentation Requirements for HR Compliance HR compliance is complex, let’s be honest. One way to tackle this with your star quarterback is to bring your compliance to one central location: Employee Documentation. This is where your full compliance

Lessons to be Learned from the Recent Surge in EEOC Sexual Harassment Lawsuits

Lessons to be Learned from the Recent Surge in EEOC Sexual Harassment Lawsuits No one wants to be on the receiving end of a sexual harassment lawsuit due to employee misconduct. While this may seem like an unlikely scenario, it

Grievance Reporting Mechanisms in the Workplace

Grievance Reporting Mechanisms in the Workplace Just when we think that we have all our compliance boxes ticked and all our paperwork in order … a problem arises. In this case an employee has a grievance with a co-worker and

Three Critical Considerations When Changing or Expanding Business Locations

Three Critical Considerations When Changing or Expanding Business Locations Expansion of your business or your team is an exciting time for a business. There are clients to serve and new energy infused into the team and nothing but opportunities in

The Flexible Future of Work: Understanding Contingent Workforce

How a Contingent Workforce Can Solve Your Talent and Budget Challenges Barbara Business Owner is navigating through an exciting but challenging phase: her client base has surged and multiple projects are launching simultaneously. Thrilled by this business boom, she realizes

Decoding Mandatory Paid Sick Leave

Decoding Mandatory Paid Sick Leave Brandon Business Owner has a new concern on his radar: mandatory paid sick leave. Navigating through the terrain of paid sick leave laws feels like walking through a maze, especially when they can differ significantly

The Unintended Consequences of Switching W-2 Employees to 1099 Workers

The Unintended Consequences of Switching W-2 Employees to 1099 Workers Brandon Business Owner faces a challenging situation. His part-time employee, Emily Employee, has approached him asking for a raise. Brandon doesn’t have extra funds to increase Emily’s salary. So they

Navigating the Maze of Worker Compliance: A Tale of Two Agencies

Navigating the Maze of Worker Compliance: A Tale of Two Agencies Barbara Business Owner is an entrepreneur who has built her small but thriving business with the help of a dedicated team of independent contractors. She’s always prided herself on

Paid Sick Leave – To Pay Or Not To Pay

Understanding Mandatory Paid Sick Leave and Your Independent Contractors Mandatory paid sick leave must be provided to your employees…but what about your independent contractors? Mandatory paid sick leave… Who would have guessed that this aspect of employment can be confusing?

Lessons from Wingstop: A Focus on Worker Rights

Understanding the Wingstop Settlement: Why Compliance and Worker Rights Matter The recent settlement reached by the Seattle Office of Labor Standards (OLS) with Wingstop offers valuable insights for businesses and workers about the importance of adhering to labor laws and

Understanding the Legal Status of Independent Contractors

Understanding the Legal Status of Independent Contractors Your independent contractor should be able to prove that they are a business. But how? Did you know that your freelancers need to be able to demonstrate their legal business status? No? Today,

Lessons from the Arise Virtual Solutions Labor Law Case: A Call for Worker Compliance

Lessons from the Arise Virtual Solutions Labor Law Case: A Call for Worker Compliance The Consequences of Misclassifying Workers You may have heard of the recent landmark case where the Department of Labor filed a huge lawsuit against Arise Virtual

Audit Warning: When your independent contractor files for unemployment

Audit Triggers: Here is what happens when your independent contractor files for unemployment. Do you know about the most common audit trigger for small businesses? Today, I’m going to be talking about an audit trigger so common, I’m considering coining

Worker Classification: What is the Nature of Work my Independent Contractors are allowed to complete?

What work are my Independent Contractors allowed to complete? This is a big guideline that is often misunderstood. Independent contractors cannot provide integral services related to the business. Have you ever thought about the nature of the work your workers

Defining and Documenting the ‘Relationship of the Parties’

Worker Classification: How Understanding The Relationship Of The Parties Can Help Prevent Misclassification Establishing a clear relationship with your workers can help to prevent misclassification and potential audits. A working relationship has a number of different definitions in our

Financial Control and the Independent Contractor

Worker Classification: The Importance of Financial Control Understanding financial control is a great way to properly classify your workers Do your workers have financial control over their career? Financial control simply refers to the level of control your workers

Behavioral Control and Your Workers

Worker Classification and Behavioral Control Understanding Behavioral Control is very important – and here’s why … When it comes to the workforce that powers your business there are times when you need to rely on employees and there are

5 Risks of Hiring an Independent Contractor

What you should be aware of when hiring an Independent Contractor Hiring an independent contractor these days is like a no-brainer, right? Especially when you start thinking about the cost-effectiveness, the ocean of diverse talent and skills readily available

When Should You Use an Employer of Record?

Are you considering growing your business and hiring temporary workers to accomplish your company’s day-to-day tasks? Hiring employer of record (EOR) services will help you along that trajectory. An employer of record refers to a third-party organization that can serve

Semi-Annual Update – Minimum Wage Rates – January 2023

Our Semi-annual Update of Minimum Wage Rate Changes ClearPath keeps up with the state-by-state (and city-by-city in some cases) minimum wage rates changes. Is your state or city’s minimum wage increasing again? If you employ workers, you should check to

Semi-Annual Update – Paid Sick Leave Ordinances – January 2023

Our Semi-annual Update of Paid Sick Leave Ordinances ClearPath keeps up to date on the expanding changes to paid sick leave requirements. As a result of the gaps left by the federal response to the pandemic, state and local

Semi-Annual Update – Sexual Harassment Training Requirements – January 2023

Sexual Harassment Training Mandates by State for 2023 Preventing sexual harassment has been on the agenda for most companies since Title VII of the Civil Rights Act of 1964, which prohibits sexual harassment and discrimination in the workplace. But

Mistakes to Avoid When Working with Independent Contractors

Sometimes, employers purposely treat their employees as independent contractors to avoid paying for employee benefits and taxes. Other times, some companies make genuine mistakes when interpreting confusing and lengthy guidelines. For these reasons, the Department of Labor (DOL) and the

Consequences of Misclassifying Employees as Independent Contractors

It’s perfectly acceptable for companies to rely on independent contractors to supplement their staff and get the work done. However, what’s not acceptable is the misclassification of employees as independent contractors to cut costs. Unfortunately, up to 30% of employers

Documents You Need to Hire an Independent Contractor

Many industry experts claim that independent contractors will soon make up most of the American workforce within the next decade. Consequently, this shift compels company owners to rethink their business model if their existing employee skillsets aren’t enough to tackle

Key Aspects Where Gig Workers Suffer Potential Harm

Almost everyone knows that more and more industries have been tapping into gig workers since the economic recovery in 2021. With the gig economy exploding, things are changing quickly for both employers and workers. Moreover, as millions of workers look

Most Asked Questions About Employer of Record Services

As the rising number of remote workers leads to more online collaboration, the workforce has significantly evolved, and the hiring process is changing. For this reason, company owners hire employer of record services to free up more time for managing