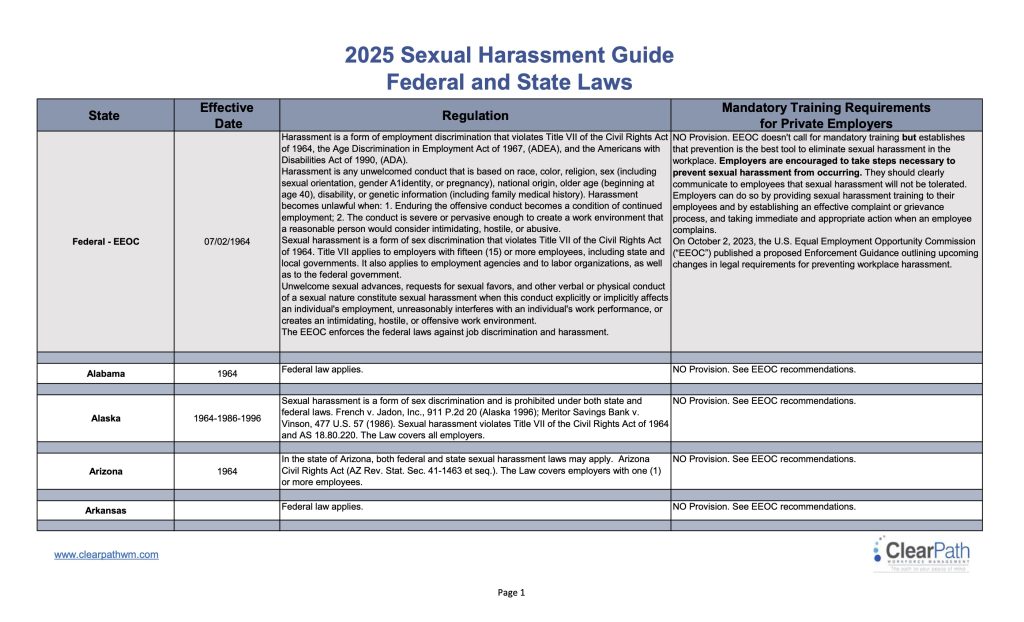

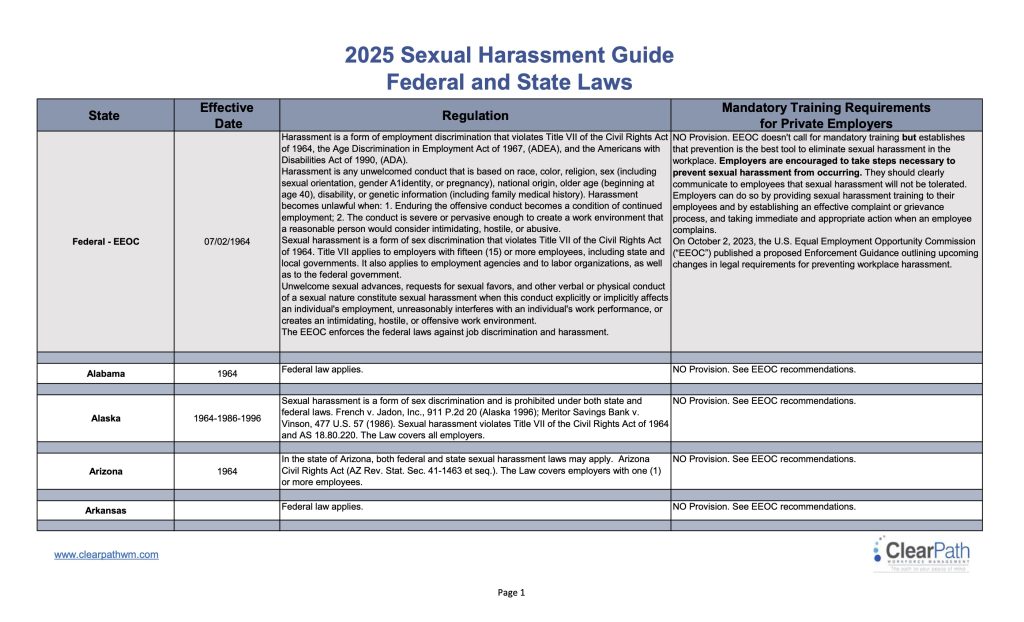

Semi-Annual Update – Sexual Harassment Training Requirements – January 2026

Preventing Sexual Harassment: Are You Compliant? In the U.S., sexual harassment laws are governed at the state level, meaning compliance requirements can vary widely depending on where your employees are located. While all states share the same goal—to eliminate harassment

Semi-Annual Update – Paid Sick Leave Ordinances – January 2026

Stay Compliant with Our Semi-Annual Paid Sick Leave Ordinance Update Paid sick leave laws are evolving rapidly across the U.S., and staying compliant has never been more complex—especially for businesses operating in multiple locations. As federal responses to the pandemic

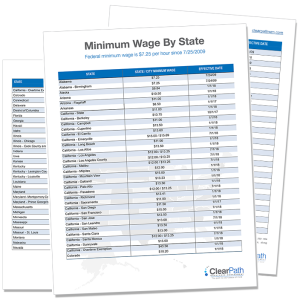

Minimum Wage Semi-Annual Update – January 2026

Minimum Wage Semi-Annual Update: Are You in the Know? Minimum wage rates continue to change across the country—sometimes even at the city level. Is your state or city increasing its minimum wage again? If you have employees, it’s important to

Semi-Annual Update – Paid Sick Leave Ordinances – July 2025

Stay Compliant with Our Semi-Annual Paid Sick Leave Ordinance Update Paid sick leave laws are evolving rapidly across the U.S., and staying compliant has never been more complex—especially for businesses operating in multiple locations. As federal responses to the pandemic

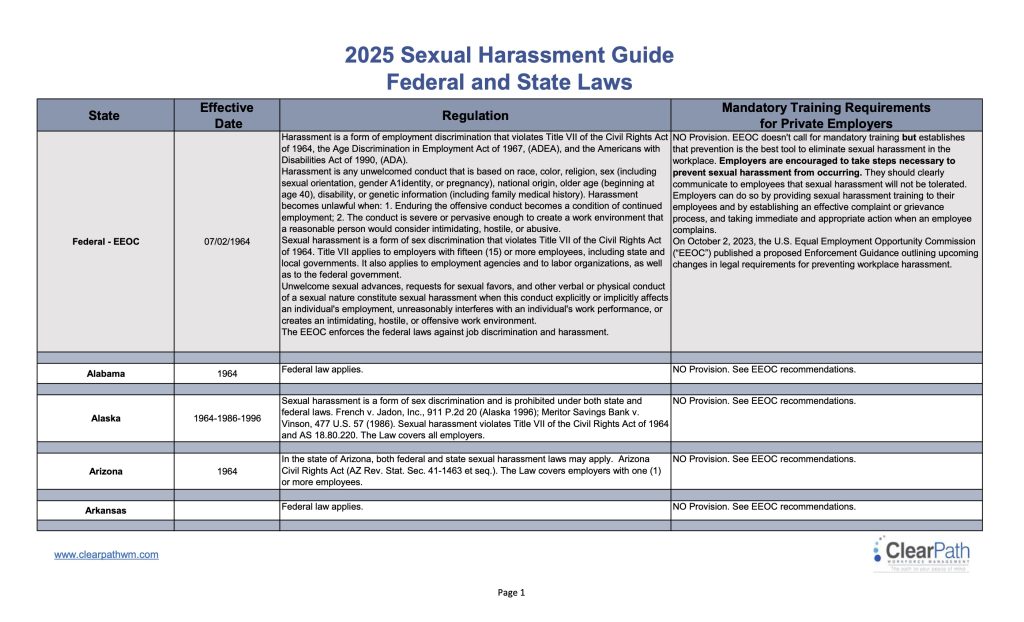

Semi-Annual Update – Sexual Harassment Training Requirements – July 2025

Preventing Sexual Harassment: Are You Compliant? In the U.S., sexual harassment laws are governed at the state level, meaning compliance requirements can vary widely depending on where your employees are located. While all states share the same goal—to eliminate harassment

Minimum Wage Semi-Annual Update – July 2025

Minimum Wage Semi-Annual Update: Are You in the Know? Minimum wage rates continue to change across the country—sometimes even at the city level. Is your state or city increasing its minimum wage again? If you have employees, it’s important to

Hiring Decisions: Getting It Right from the Start

Hiring Decisions: Getting It Right from the Start Hiring the right person starts before a job post or an interview is scheduled. Before candidates are identified, you need to clarify the structure of the role—and that begins with how the

Employee Notices: What You’re Required to Share – and Why It Matters

Employee Notices: What You’re Required to Share – and Why It Matters If you’ve ever walked into a breakroom and seen a tattered labor law poster hanging on the wall, you’ve seen a glimpse of what employee notices are all

Employee Benefits: The Basics and Beyond

Employee Benefits: The Basics and Beyond Every benefits package starts with the essentials—health coverage, retirement savings, and compliance with the law. These foundational elements are non-negotiable. They support employee well-being, meet federal and state requirements, and set the tone for

The Importance of Backup Personnel: Ensuring Business Continuity

The Importance of Backup Personnel: Ensuring Business Continuity In any business, certain functions are absolutely critical – especially payroll and Human Resources. If a key employee suddenly becomes unavailable, do you have a backup plan in place? Without proper preparation,

Handling Employee Relations

Handling Employee Relations: Addressing Concerns, Protecting Your Business Employee relations matters are inevitable in any workplace. Whether it’s a complaint about management, concerns over workplace safety, or accusations of discrimination, how a company handles these issues can make all the

Off-Boarding Employees: A Critical Business Process

Off-Boarding Employees: A Critical Business Process Terminating an employee—whether voluntary or for cause – is never easy, but handling it correctly is essential to protecting your business from legal and financial risks. A structured off-boarding process ensures compliance, mitigates co-employment

Managing Personnel Files: Why Proper Documentation Matters

Managing Personnel Files: Why Proper Documentation Matters Personnel files are more than just a collection of paperwork—they serve as a critical component of compliance, legal protection, and employee management. Every business, regardless of size, must maintain organized and secure personnel

The Overlooked Role of HR

The Overlooked Role of HR Many business owners underestimate just how many responsibilities fall under the HR department. From compliance management to handling leaves of absence and unemployment claims, HR is a critical function that ensures smooth operations and protects

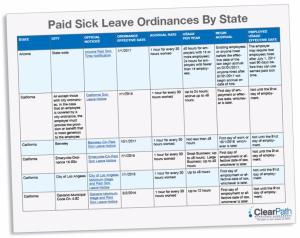

The Evolution and Complexity of Paid Sick Leave

The Evolution and Complexity of Paid Sick Leave Over the past decade, the landscape of paid sick leave has undergone a dramatic transformation. In 2015, there were only 11 cities in the U.S. with mandatory paid sick leave policies. Fast

The True Cost of Paying Employees: What Business Owners Need to Know

The True Cost of Paying Employees: What Business Owners Need to Know Payroll may seem straightforward—pay your employees for their time, issue a paycheck, and move on. But any business owner who has managed payroll firsthand knows that beneath the

Cutting Costs & Maximizing Profit Margins in 2025

Cutting Costs & Maximizing Profit Margins in 2025 In our previous articles, we explored how today’s business landscape and “workscape” demands a smarter approach in 2025. We discussed how evolving compliance, economic shifts, and remote work have permanently altered hiring

The Evolution of Business: Navigating the New Workscape

From the desk of Renee Fink, CEO The Evolution of Business: Navigating the New Workscape Last week, we explored how today’s business landscape presents new, persistent challenges that make profitability and workforce management more complex than ever. If you’ve been

Unprecedented Times … for Business Growth and Profit

From the desk of Renee Fink, CEO Unprecedented Times … for Business Growth and Profit If you are anything like me, you are likely weary hearing that ‘we live in unprecedented times.’ There seems to be a crisis every year

Semi-Annual Update – Sexual Harassment Training Requirements – January 2025

Sexual Harassment Training Mandates by State for 2025 Preventing sexual harassment has been on the agenda for most companies since Title VII of the Civil Rights Act of 1964, which prohibits sexual harassment and discrimination in the workplace. But

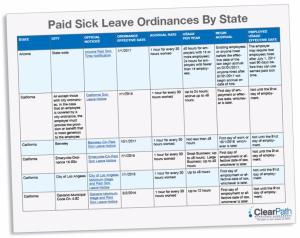

Semi-Annual Update – Paid Sick Leave Ordinances – January 2025

Our Semi-annual Update of Paid Sick Leave Ordinances ClearPath keeps up to date on the expanding changes to paid sick leave requirements. As a result of the gaps left by the federal response to the pandemic, state and local

Semi-Annual Update – Minimum Wage Rates – January 2025

Our Semi-annual Update of Minimum Wage Rate Changes ClearPath keeps up with the state-by-state (and city-by-city in some cases) minimum wage rates changes. Is your state or city’s minimum wage increasing again? If you employ workers, you should check to

The True Cost of Managing Employees

The True Cost of Managing Employees Are you a business owner that wants to grow your business? Do you need to expand your team to do so? People who have a successful business and want to grow will most likely

Direct Hire vs. Strategic Workforce Partner

1099 or Employee? A Hiring Guide for U.S. Businesses As businesses expand and face evolving employment regulations, selecting the right approach to workforce management is more important than ever. Companies often grapple with whether to directly hire and manage employees

1099 or Employee? A Hiring Guide for U.S. Businesses

1099 or Employee? A Hiring Guide for U.S. Businesses Choosing between hiring a 1099 independent contractor or a W-2 employee is crucial for any business. The distinction isn’t just about payroll—your choice affects compliance, taxes, and your business’s long-term stability.

The Ultimate Guide to Choosing an Employer of Record

The Ultimate Guide to Choosing an Employer of Record As companies expand, especially with remote and international teams, many turn to Employer of Record (EOR) services to manage the complexities of payroll, compliance, and HR. An EOR becomes the legal

Simplified Expansion: Growing Beyond State Borders Without the Hassle

Simplified Expansion: Growing Beyond State Borders Without the Hassle Dreaming of expanding your business into out of state markets? That’s exciting! But before you pop the champagne, let’s talk about the not-so-glamorous side of expansion: hiring, managing, and paying employees

Employer of Record Services: A Return on Investment

Employer of Record Services: A Return on Investment When you think about hiring an Employer of Record (EOR), the first thing that might come to mind is the cost. Yes, using an EOR is an investment, but here’s the thing:

A Safeguard Against Misclassification

A Safeguard Against Misclassification Hiring independent contractors can feel like a smart, cost-effective solution – until you realize the potential risks of misclassifying workers. What might seem like a money-saver today could end up costing you big time in fines,

HR Expertise Without the Hassle

HR Expertise Without the Hassle Imagine having access to a full team of HR, legal, and payroll experts without the hefty price tag of hiring an entire department. Does that sound too good to be true? Join us if you

How to Streamline Payroll and Tax Filings

How to Streamline Payroll and Tax Filings Let’s face it—payroll is way more than just sending out paychecks. It’s like a puzzle that involves tracking hours, juggling tax withholdings, making sure everyone gets their year-end tax forms, and, of course,

The Maze of Workforce Compliance Management

The Maze of Workforce Compliance Management We all know compliance can feel like a never-ending game of “keep up or else.” Every time you think you’ve got employment laws and tax regulations figured out, an updated or new regulation goes

Independent Contractors and Audit Risks

Independent Contractors and Audit Risks Hiring Independent Contractors Independent contractors are great – you can ask Barbara Business Owner, Brandon Business Owner, or Holly Human Resources. They will all agree that there is a time and place when contractors are

Outsource the HR Headache

Can we be honest — it’s unlikely that your company started because you were excited about payroll and compliance paperwork. Yet, here we are, juggling those time-consuming tasks that feel like they belong in the “necessary evil” part of running

5 Risks of Hiring an Independent Contractor

What you should be aware of when hiring an Independent Contractor Hiring an independent contractor these days is like a no-brainer, right? Especially when you start thinking about the cost-effectiveness, the ocean of diverse talent and skills readily available

Audit Warning: When your independent contractor files for unemployment

Audit Triggers: Here is what happens when your independent contractor files for unemployment. Do you know about the most common audit trigger for small businesses? Today, I’m going to be talking about an audit trigger so common, I’m considering coining

Worker Classification: What is the Nature of Work my Independent Contractors are allowed to complete?

What work are my Independent Contractors allowed to complete? This is a big guideline that is often misunderstood. Independent contractors cannot provide integral services related to the business. Have you ever thought about the nature of the work your workers

Defining and Documenting the ‘Relationship of the Parties’

Worker Classification: How Understanding The Relationship Of The Parties Can Help Prevent Misclassification Establishing a clear relationship with your workers can help to prevent misclassification and potential audits. A working relationship has a number of different definitions in our

Financial Control and the Independent Contractor

Worker Classification: The Importance of Financial Control Understanding financial control is a great way to properly classify your workers Do your workers have financial control over their career? Financial control simply refers to the level of control your workers

Behavioral Control and Your Workers

Worker Classification and Behavioral Control Understanding Behavioral Control is very important – and here’s why … When it comes to the workforce that powers your business there are times when you need to rely on employees and there are

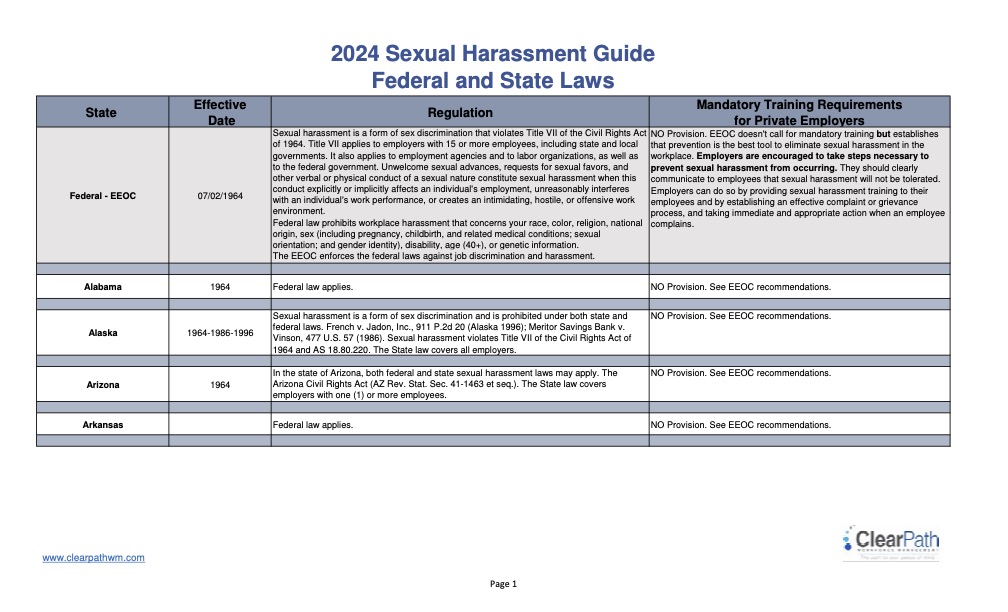

Semi-Annual Update – Sexual Harassment Training Requirements – July 2024

Sexual Harassment Training Mandates by State for 2024 Preventing sexual harassment has been on the agenda for most companies since Title VII of the Civil Rights Act of 1964, which prohibits sexual harassment and discrimination in the workplace. But

Semi-Annual Update – Paid Sick Leave Ordinances – July 2024

Our Semi-annual Update of Paid Sick Leave Ordinances ClearPath keeps up to date on the expanding changes to paid sick leave requirements. As a result of the gaps left by the federal response to the pandemic, state and local

Semi-Annual Update – Minimum Wage Rates – July 2024

Our Semi-annual Update of Minimum Wage Rate Changes ClearPath keeps up with the state-by-state (and city-by-city in some cases) minimum wage rates changes. Is your state or city’s minimum wage increasing again? If you employ workers, you should check to

The Memorandum of Understanding

The IRS and DOL Team Up to Target Worker Misclassification Have you heard about the collaboration between the IRS and the Department of Labor? If you didn’t just shudder a bit, be warned that you may soon. Today, we rejoin

Workers and Regulatory Oversight

There are numerous, modern hiring options for business growth. These include traditional employees, independent contractors, part time workers, remote workers, and contingent workers and fractional C-Suite workers (the current hiring trend). The best option really comes down to what the

Who to Hire: 1099 or Employee

Over the last several articles, we have been on a journey with Barbara Business Owner to explore her hiring options for her business. We dove deep into the worker options of 1099 or employee, the obligations she may have to

Employee Classification 101

When Barbara Business Owner started to hire for her growing business, she was not prepared for the complexities of her hiring options. Barbara was soon feeling a bit overwhelmed with the modern workforce of freelancers, part time, and remote workers

Contingent and Remote Workers in Your Business

When it comes to hiring workers for her business, Barbara Business Owner is realizing that there are a number of workforce solutions available. While the two primary hiring approaches are 1099 or employee, the options, criteria, and regulations around both

1099s in Your Business

When Barbara Business Owner was looking to expand her team to support her growing business, she started to delve into the world of workforce options beyond the traditional full-time and part-time employees. There are independent contractors, contingent workers, and remote

Employees in Your Business

Barbara Business Owner considers herself lucky to have very supportive friends who are also business owners. Recently, she decided to hire new talent to support her growing business, and her fellow business owners helped her realize the basic differences between a

Search

Recent Posts

Semi-Annual Update – Paid Sick Leave Ordinances – January 2026

Minimum Wage Semi-Annual Update – January 2026